Introduction

Equity research involves thorough analysis and research of the companies and its environment. Equity research primarily means analysing the company’s financials and non-financial information, study the dynamics of the sector the company belongs to, competitors of the company, economic conditions etc..

There are many frameworks/methodologies available for stock selection. You can use fundamental analysis – top-down approach or bottom-up approach – quantitative screens, technical indicators etc., to select stocks.

Fundamental analysis

Fundamental analysis is the process of determining intrinsic value for the p based on the fundamentals that drive its intrinsic value. These values depend on underlying economic factors such as future earnings or cash flows, interest rates, and risk variables. By examining these factors, you can determine intrinsic value of the stock. Investor should buy the stock if its market price is below intrinsic value and do not buy, or sell, if the market price is above the intrinsic value, after taking into consideration the transaction cost.

Investors who prefer doing stock research on fundamental analysis believe that, intrinsic value may differ from the market price but eventually market price will merge with the intrinsic value. An investor or portfolio manager who can do a superior job of estimating intrinsic value will generate above-average returns by acquiring undervalued securities. Fundamental analysis involves economy analysis, industry analysis, company analysis.

Top down approach vs bottom up approach

Analysts follow two broad approaches to fundamental analysis—top down and bottom up. The factors to consider are economic (E), industry (I) and company (C) factors. Bottom up approach is the Beginning at company-specific factors and moving up to the macro factors that impact the performance of the company.

Scanning the macro economic scenario and then identifying industries to choose from and zeroing in on companies, is the top-down approach. You use EIC framework to understand fundamental factors impacting the earnings of a company, scanning both micro and macro data and information.

Stock analysis process

The expected cash flows and the investor’s/analyst’s required rate of return (i.e. its discount rate) determine the value of the investment.Economic environment influence the expected cashflows as well as required rate of return. The analyst needs to have good understanding of important economic variables and economic series. The macroeconomic analysis provides a framework for developing insights into sector and company analysis.

Economy analysis

Macro-economic environment influences all industries and companies within the industry. Monetary and fiscal policy influences the business environment of the industries and companies. Fiscal policy initiatives such as tax reduction encourages spending while removal of subsidies or additional tax on income discourages spending.

Similarly, monetary policy may reduce the money supply in the economy affecting the expansionary plans and working capital requirements of all the businesses. Hence a thorough macro-economic forecast is required to value a sector/firm/equity. Any macro-economic forecast should include estimates of all of the important economic numbers, including gross domestic product, inflation rates, interest rates unemployment etc.

The most important thing you can do is to watch for releases of various economic statistics by the government, central bank and private sources. Especially, they keep a keen eye on the Index of economic indicators like the WPI, CPI, monthly inflation indices, Index of Industrial Production, GDP growth rate etc. Analysts assess the economic and security market outlooks before proceeding to consider the best sector or company. Interest rate volatility affect different industries differently. Financial institution or bank stocks are among the most interest-sensitive of all sectors. interest rate change affect sectors such as pharmaceutical in small manner.

The economy and the stock market have a strong and consistent relationship. The stock market is a leading economic indicator. A leading economic indicator is a measure of economic recovery that shows improvement before the actual economy does because stock price decisions reflect expectations for future economic activity, not past or current activity.

Industry/sector analysis

Industry analysis is an integral part of the three steps of top-down stock analysis. Is identify both unprofitable and profitable opportunities. Industry analysis involves conducting a macro analysis of the industry to determine how different industries relate to the business cycle. the stage of the business cycle relate to the performance of industries.. Different industries perform differently in different stages of the business cycle. On the basis of the relationship different sectors share with the business cycles, they are classified as cyclical and noncyclical sectors.

For example, banking and financial sector perform well towards the end of a recession. During the phase of recovery, consumer durable sectors such as producers of cars, personal computers, refrigerators, tractors etc. become attractive investments.

Cyclical industries are attractive investments during the early stages of an economic recovery. These sectors employ high degree of operating costs. They benefit greatly during an economic expansion due to increasing sales, as they reap the benefits of economies of scale. Similarly, sectors employing high financial leverage also benefit during this phase, as debt is good in good times.

At the peak of business cycle, inflation increases as demand overtakes supply. Inflation impacts different industries differently. There are industries, which are able to pass on the increase in the costs of products to their consumers by increasing prices. Their revenue and profits may remain unaffected by inflation. Industries producing basic materials such as oil and metals benefits the situation. Rising inflation doesn’t impact the cost of extracting these products. These industries can increase prices and experience higher profit margins. However, there are industries that are not able to charge the increased costs of production to their consumers. Their profitability suffers due to inflation.

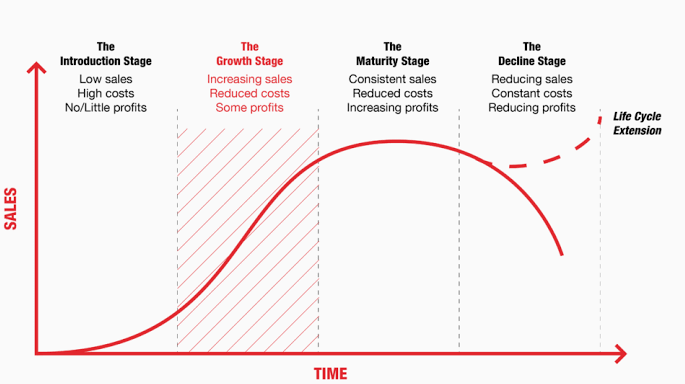

During a recession phase also, some industries do better than others. Defensive industries such as consumer staples, pharmaceuticals, FMCG, outperform other sectors. In such times, even though the spending power of consumer may decrease, people still spend money on necessities. Analysts also see the stage of the industry is in its life cycle. The number of stages in the life cycle of the industry is as follows

Industry life cycle

Introduction

During this stage, industry experiences modest sale and very small or negative profit. The market of the products of the industry is small and the firms in the industry may have high development costs.

Growth

During this stage, market develops for the products or services of the industry. Number of firms in the industry is less during this phase and hence they may have little competition. Profit margins at this stage are generally high. The rapid growth of the earlier phase attracts competitors contributing profits margins go to normal levels.

Maturity

This is generally the longest phase in the life cycle of the industry. During this stage, growth rate in the industry normally matches with the economy’s growth rate. Firms in the industry differ from one another given their cost structure and ability to control costs. Competition is high during this stage reducing the profit margin to normal levels.

Deceleration of growth and decline

This stage observes decline in sales due to shift in demand. Profits margins are under pressure and some firms may even witness negative profits. Similar to life cycle analysis, you need to analyze competitive structure of the industry. It is a key factor affecting the profitability of the firms in the industry. Competition influences the rate of return on invested capital. If the rate of return is “attractive” it will encourage investment.

Company analysis

Company analysis is the final step in the top-down approach to stock analysis. Macroeconomic analysis prepares us to understand the impact of forecasted macro-economic environment on different asset classes. It enables us to decide how much exposure to be made to equity.

Industry analysis helps us in understanding the dynamics of different industries in the forecasted environment. It enables us to identify industries that will offer above-average risk-adjusted performance over the investment horizon. If trends are favourable for an industry, the company analysis focusses on firms in that industry that benefits from the economic trends.

The final investment decision to be made is with regard to which are the best companies in the desirable industries? And are they attractive investments in terms of risk-adjusted returns. Company analysis is different from stock valuation. Conduct Company analysis to understand its strength, weaknesses, opportunities and threats.

Use these inputs to determine the fundamental intrinsic value of the company’s stock. Then compare this value with the market price of the stock. If the intrinsic value is higher than the market price, buy the stock and vice versa. It is very important to note that stocks of good companies need not make good investment opportunities. The stock of a good company with superior management and strong performance measured by current and future sales and earnings growth can be trading at a price much higher to its intrinsic value. It may not make a good investment choice. Company analysis helps to determine the value of the stock. There are many components to company analysis.

Financial statement analysis of the company is often the starting point in analysing company. Analysing the profit and loss account, balance sheet and the cash flow statement of the company is imperative. The financial performance numbers of a company, as presented in the financial statements, helps to calculate ratios that gives a snapshot view of the company’s performance. The ratios of a company have to be seen in conjunction with industry trends and historical averages.

SWOT analysis

Another important component of company analysis is SWOT Analysis. SWOT analysis involves examination of a firm’s, strengths, weaknesses, opportunities, and threats. Strengths and weaknesses deal with company’s internal ability, like company’s competitive advantage or disadvantages. Opportunities and threats deal with external situations and factors the company is exposed to.

Opportunities include a favourable tax environment, favourable change in consumer preference. An example of threat is stringent government regulation, or a big sized competitor, or changing technology etc.

Company analysis also involves analysing its competitive strategies. A firm may follow a defensive strategy. A defensive strategy is one where the firm positions itself in such a way that its capabilities provide the best means to deflect the effect of competitive forces in the industry. Alternatively, a firm may be following an aggressive strategy in which the firm attempts to use its strengths to affect the competitive forces in the industry.

Michael Porter suggests two major strategies: Cost Leadership and Differentiation. Cost Leadership: Under this strategy the firm seeks to be the low-cost producer, and hence the cost leader in its industry. Cost advantages vary from industry to industry. Differentiation Strategy: Under this strategy, the firm positions itself as unique in the industry. Again the possibilities of differentiation differ from industry to industry. Another very important component of company analysis is understanding the business model of the company. As part of it, the following questions need to be asked.

What does the company do and how does it do?

Who are the customers and why do customers buy those products and services?

How does the company serve these customers?

Almost all successful investors and fund managers repeat this thought that one must invest only in such firms where one understands the business. In the checklist for research, this is one of the most prominent questions – ‘Do I understand the business?’ No analyst should move to the next question if he/she can’t address what a company does in a line with preciseness and clarity. There are over 6000 companies listed on Indian exchanges. It is not possible to track and understand all of them.

Investors should consider buying shares of few companies they understand rather than invest in a number of companies they don’t understand. Further, each sector has its own unique parameters for success, sales growth and profitability. For the retail sector, footfalls and same store sales (SSS) are important parameters, whereas for banking it is Net Interest Income (NII)/ Net Interest Margin (NIM). For telecom, it is Average Revenue Per User (ARPU) and for hotels, it is average room tariffs and room occupancy etc.. Analysts must possess an in-depth knowledge of the sectors while researching companies.

Further, each company will have its unique way of doing business. The efficiency with which products and services are produced and delivered to the customers may vary from one business to another and will significantly impact its earnings. Therefore, it becomes imperative for analysts to understand the entire business model of companies.

Estimation of intrinsic value

Once the analysis of economy, industry and company is completed, the analyst can go ahead with estimating intrinsic value of the firm’s stock. Price and value are two different concepts in investing. While price is available from the stock market and known to all, value is based on the evaluation and analysis of the entity that is undertaking the valuation of the stock at a point in time.

It may be noted that Price is a Fact but Value is an Opinion. There are various approaches to valuation. They are explained in the subsequent paragraphs. There are uncertainties associated with the inputs that go into these valuation approaches. As a result, with due diligence, the final output can at best be considered an educated estimate. That is the reason, valuation is often considered an art as well as a science. It requires the combination of knowledge, experience, and professional judgment in arriving at a fair valuation of any asset. The purpose of valuation is to relate market price of the stock to its intrinsic value and judge whether it is fairly priced, over-priced, or under-priced.

Three most popular approaches to valuation viz., discounted cashflow approach, asset based approach and relative multiple based approach. I will upload blogs on those topics later.

Conclusion

Fundamental analysis is just another aspect of stock trading just like technical analysis and derivative trading. Learning fundamental analysis takes time. Acquiring skills of trader takes patience and preservence.

Leave a Reply