You started your investment journey now you are confusing yourself with stocks, bonds,Etfs, other investment products. You don’t really understand how to approach all those products while making an investment plan. So You become confused when you consider the factors such as age, goals, good approach, bad approach.

In this article I discuss all problems and how you can make a perfect investment plan.

Step 1.Get clear about your current position

Currently you are unemployed, or have huge amounts of debt over your shoulder. So you shouldn’t target high ambitious goals at this moment like buying few luxury cars or going to exotic travel locations. Currently, If you are not in the above mentioned position then you can comfortably make good financial plans according to your own convenience. If you’re unemployed or have huge debt, your first target is to get a job, get rid of debt over your shoulder.

Be clear about your goals. Do some introspection.

Ask yourself the following questions.

- what should be your retirement age?

- what is the expected income I should receive at my retirement stage?

- what is the annual corpus I should target to accumulate keeping inflation in mind?

- how should I deal with them if I experience unexpected economic or health crisis?

Step 2.List down all your assets and liabilities in paper in two column

Follow this step as you go through this article. Take a sheet of paper and draw a line in the middle of it. Write down assets and liabilities in two separate columns. In assets section write everything that gives you money. It includes your savings, regular interest of bank accounts, side hustles, your rental property, anything that only gives you money in return. Don’t add occasionally earned money. In liabilities,add everything that takes money out of your pocket. It includes loan amounts like house loans, car loans, bike loans, mortgage amounts, education loans (it’s an investment to your career though, but you will become more conscious of your financial health), personal expenses.

Step 3.Budget everything

Now you get the list. Now start making budget on everything you spend. That includes your monthly expense, grocery expenses,electric bill, cost of mobile, internet costs to costs of education, personal care. Track everything from 2months to 1year. You will become more conscious if you keep on tracking your expenses for long enough time. You can use diary or online apps. Now you know what is your monthly expenses, what is current savings, what are the fixed monthly expenses,what are unnecessary expenses, what are basic needs etc.

Step04.Save as much as you can

Now you know all the necessary, unnecessary, luxury needs. Feeding yourself on home cooked meal is necessity. But dining out 3-4times a week is a luxury. Don’t use online payment methods. I repeat don’t use online payment methods. You create an impulsive buying habits by using online payment methods. Use cash. Deposit the every expense in single envelope with cash at the start of month. If you are under debt then only allow necessary expenses removing all unnecessary, luxurious spending.

If you are not able to crush your financial goals then there must be something you are missing in your expenses sheet. Find it & change it. You can buy second hand books, buy library cards. You use internet to download books or get information regarding studies. The point is figure out the difference between the need and the wants.

Step 5.Buy insurance

Insurance companies create unnecessary problems. But still a good health insurance is vital for every family. You just need to make sure that you fill correct information, fully disclose your medical status, pay correct premium at right time. Failure to follow those can become the reasons of rejection of insurance claims.

Term insurance provide life insurance coverage with no basic savings or profit components. Premium is cheapest.

Endowment plan pay out under both scenarios – death & survival. In this case Premium is more expensive than term insurance. Always check with relevant websites to get latest information.

Step 6.Start investing like a scientist

There are huge investment products. Those are fixed deposit, public provident fund, recurring deposit, post office monthly income scheme (MIS) account, stocks/Equities, bonds, government securities, gold bonds, mutual funds,National pension scheme, employment provident fund, insurance retirement plans, senior citizens savings schemes, medical insurance etc.

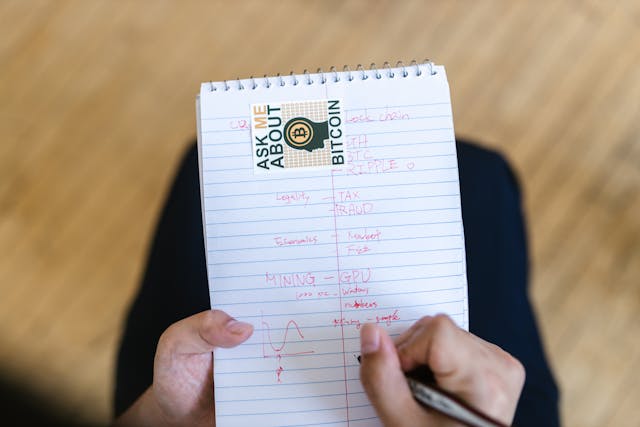

If you are from India above plans would easily align with you. But if you are from USA , France, Belgium, Japan, Saudi Arabia, UK, Spain, poland, Germany, Canada, above investment products would differ in their terms and conditions. You need to check with government websites. Overall the points that i want to make is same. Cryptocurrency is volatile so invest after you make a diversified portfolio of stocks,bonds,bank accounts.

Stocks can beat inflation in long run.

Stocks are of following types-a. growth stock, b. Income stocks, c. Value stocks, d. Large cap stocks, e. Midcap stocks f. Small cap stocks.

Mutual funds are of following types 1.equity scheme 2.debt scheme 3.hybrid scheme 4.solution oriented scheme. You can invest in mutual funds through 1.lumpsum 2.SIP 3.STP

Government securities

Government securities are bonds for both short term and long term to raise funds for their expenditure. Government pays specified interest or coupons on these bonds that may be payable annually or semi annually or any specified frequency.

Benefits

A. They carry sovereign guarantee i.e carry zero risk. B. They have attractive interest rates for tenure ranging from 91days to 40years. C. You can hold in the demat form.

Look at the bonds coupon or interest rates. This is what you will get annually. Hold it untill it matures. In maturity you will get face value with remaining interest payout.

In sovereign gold bonds you earn assured interest of 2.5% per annum. Investment portfolio are of following types-1. Growth portfolios 2.income portfolios 3.value portfolios.

Now if you are on the young side you can take high risk like Equity option getting low exposure on mutual funds and bonds. As you age lower your percentage of equities. Increase your portfolios in mutual funds,bonds,golds after reviewing semi annually or annually.

Step 7. Prepare for crisis by having an investment policy statement

We often experience crisis ranging from dot com bubble, 2008 market crash, covid-19. All those events affected our portfolios. So have plan for next crisis. When economy experiences two consecutive gdp growth in negative rate then that country’s economy is in recession. Recession can be a good time to buy high value stock at low price. Make a plan to liquidate your investment before crisis hits.

Step 8.Find a good financial advisor

A good financial adviser should ask you various questions of what money means to you.

Step 9.Make emergency fund

We often vary our opinions about duration of emergency fund. What should be savings in emergency fund? My opinion is to have 2years of emergency fund. If you can’t arrange money for 2years at once then try for 6months to 1year.But end goal is to have 2years emergency fund.

Conclusion

I am discussing all long term steps that we should take to secure our financial future. All of these can create anxiety about our future. So the point to take one step at one time. First get rid of debt, make emergency fund of atleast 3-6months. Make few income streams, increase the value of emergency fund to 1-2years. Learn about stocks, bonds, mutual funds, other investment products. Then make valuable portfolios depending on your age. Don’t think about everything all at once. Avoid unnecessary tensions. Thanks for reading.

Leave a Reply