Overview

Investors approach securities market to invest and disinvest their extra funds. They have predefined features. They are easily liquidifiable. Liquidity means the existence of sellers when one needs to buy and buyers when one needs to sell. Those who seek capital from investors issue equity and debt. These two are broad types of securities for capital funding. Companies issue equity or shares that gives rights to own small percentage of their own companies. Companies issue debt securities to provide the rights of lender to the investors. Both of these securities differ in certain features in claim of the companies.

Equity investors, also called share holders have residual claim in the business because they are owners of company but not lenders. Companies who issue securities from time to time are not liable to repay the amount it receives from shareholders. They are not liable to pay periodic payments to shareholders for the use of their funds like interest payment in case of lenders. If you are equity investors you get voting rights. When we investors get a sizeable amounts of shares in a company they get an opportunity to participate in the management of the business.

Investors make profits out of equity shares by looking for capital appreciation and dividend income. Companies don’t assure to give the both to investors. The choice of giving dividend depends on the decision of management of companies and capital appreciation depends on the conditions of stock market. It’s a trade off when you have to choose between equity and debt. Investors desiring low risk choose debt at the cost of lower stable return. However if you want higher return choose equity investment. Most investors tend to allocate their capital between these two choices depending on the expected return, their investing time period, their risk appetite and their needs.

Diversification

When you compare between equity, bonds, other assets classes, equity is inherently risker. Diversification allows the ways to reduce risk. You can diversify across business sector,industries as well as various time periods. Diversification reduces significant portion of risk. This is what old adage “don’t put all your eggs in one basket” means.

You can hold equities in various different kinds of business at a point in time and also across various geographies of the world. Reaping the benefits of time diversification requires investing in equities for a long period of time. Good times cancel bad times. That’s the belief. That is why “time in market” is important as against “timing the market”.

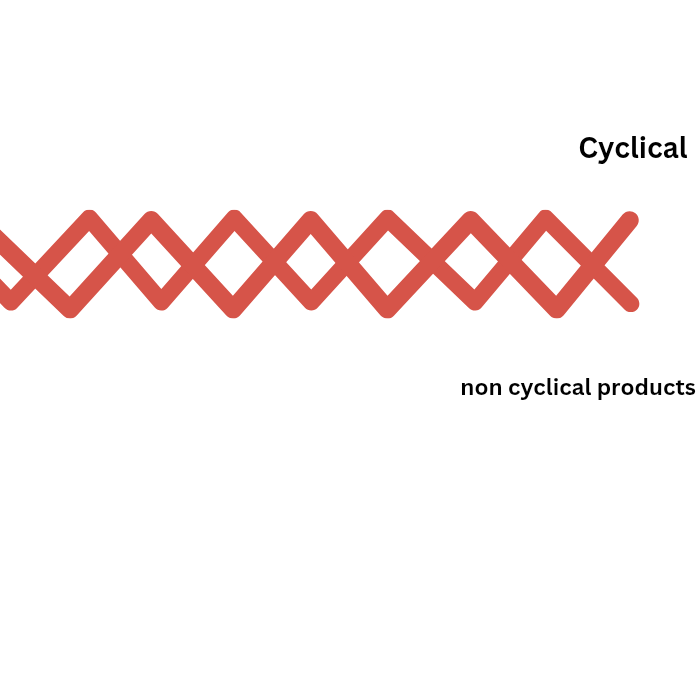

In the picture below, A dark line shows the business cycle. Some businesses may be at peak when the business cycle is in the trough as shown by broken line. These products are counter cyclical or defensive business. Business that do better in a recession are called recession proof business. Some leading sectors, their products, countries come out of recession faster than others. Some sectors go into recession later than others. They are lagging sectors.

Equities are often risker than other assets classes. Main types of risk are below

1.market risk

Market risks arise due to the fluctuations in the prices of equity shares due to various market related dynamics. These factors affect all the listed, market traded assets, irrespective of their business sector. The degree of impact may be different. Beta is a proxy measure for market risk. You cannot diversify away the market risk, you can hedge it.

2.sector specific risk

These risks due to sector specific factors are not part of market risks. You cannot diversify away by investing in different business sectors. Sector specific risks arise due to factors that affect the performance of businesses in a particular sector/industry. Factors affecting certain sectors might not impact certain other sectors. Such risks are “idiosyncratic risks”.

Say for instance there are restrictions on the movement of international tourists, the airline industry and hospitality industry are going to be affected. But such restrictions don’t affect industries and business sectors dependent on domestic customers.

3.company specific risk :

These risks arising due to company specific factors are also non-market risks. You can diversify away these risks by investing in different companies. Company specific risk arises due to factors that affect only the performance of a single company and other firms may not get affected by them. Though, overall, the airline industry goes through turbulent times, time and again, certain airlines withstood the rough weather and others exited helplessly. Such corporate debacles are due to company specific factors. Same is now being seen in telecom sector.

4.liquidity risk:

Measure it by measuring impact cost. The impact cost is the percentage price movement – caused by a particular order size (let’s say an order size of Rs.1 lakh) – from the average of the best bid and offer price in the order book snapshot. Calculate the impact cost for both—the buy and the sell side. Less liquid stocks are more thinly traded, and a single large trade can move their prices considerably. Such stocks have high impact costs. A lower market impact implies the stock is more liquid

5.currency risk:

Prima facie, it appears that prices of equity does not relate to currency risk. However, once the financial markets are open to the international investors, currency risk sets in. Currency risk arises due to uncontrollable, unpredictable and volatile exchange rates of various pairs of currencies. When a significant proportion of players in a financial market belong to the international institutional investors groups, then that financial market is bound to be related to exchange rate movements.

Many times we hear that stock market reacts to FPIs’ buy and sell pressure, and FPIs move in and move out of a country with changes in their home country interest rates, or due to sudden unfavourable exchange rate movements, like deep depreciations in their host countries or due to any other socio-politico-economic, industry or market shocks. Apart from the above most prominent risks, all other macro-economic factors like inflation, fuel prices, interest rates, economic growth, economic slowdown, do influence stock markets.

Overview of equity markets

Equity securities represent ownership claims on a company’s net assets. You need to understand equity market to make optimal allocation to this asset class. The equity market provides various choices to investors in terms of risk-return-liquidity profiles. There are opportunities in listed as well as unlisted equity space. Investments in listed companies are relatively more liquid than investment in unlisted companies. Listed companies have to abide by the listing norms, making this investment space more regulated with better disclosures.

In addition to equity shares, companies may also issue preference shares.

Preference share

Preference Shares rank above equity shares with respect to the payment of dividends and distribution of company’s net assets in case of liquidation. However, preference shares do not generally have voting rights like equity shares, unless stated otherwise. Preference shares share some characteristics with debt securities like fixed dividend payment. Similar to equity shares, preference shares can be perpetual.

Dividends on preference shares can be cumulative, non-cumulative, participating, non-participating or some combination thereof (i.e. cumulative participating, cumulative non-participating, non-cumulative participating, non-cumulative non-participating).

In case preference stock is cumulative, the unpaid dividends would accumulate to be paid in full at a later time, whereas in non-cumulative stocks the unpaid or omitted dividend does not get paid.A non participating preference share is one in which a dividend is paid, usually at a fixed rate, and not determined by a company’s earnings. Participating preference share gives the holder the right to receive specified dividends plus an additional dividend based on some pre-specified conditions.

Participating preference shares can also have liquidation preferences upon a liquidation event. Preference shares can also be convertible. Convertible preference shares entitle shareholders to convert their preference shares into a specified number of equity shares. Since preference shares carry some characteristics of equity share and at the same time some of the debt securities, they are hybrid or blended securities.

The chief characteristic of equity shares is shareholders’ participation in the governance of the company through voting rights. Generally companies issue only one kind of common shares, on the principle of ‘one share, one vote’.

Differential voting rights (DVR)

Some companies, however issue share with differential voting rights (DVRs). Shares with DVRs can either have superior voting rights (i.e. multiple votes on one share) or inferior voting rights (i.e. a fraction of the voting right on one equity share) or differential rights as to dividend.

Shares with DVRs are very popular in the western world for many decades. They have not really gained momentum in India. Though way back in 2000, the Companies Act, 1956, was amended to permit issuance of shares with DVRs, not many companies have issued shares with DVRs. Tata Motors was one of the first companies in India to issue DVRs in 2008.

These DVRs carried 1/10 voting rights and 5% higher dividend than ordinary shares. Since then, Pantaloon Retails (currently Future Enterprises Ltd.), Gujarat NRE Coke Ltd., Jain Irrigation Systems Ltd. have issued DVRs. Companies issuing equity shares can be classified on the basis of size—measured by way of their market capitalization as ultra large cap, large cap, mid-cap, small cap, micro-cap etc., each group represents a particular risk-return-liquidity profile. For example large cap companies as a group have lower variability in return than small cap companies. Technological advancements and integration of global markets have expanded the investment opportunity set for the investors. They can invest in global equities within the restrictions placed by the RBI.

Conclusion:

It is the beginning of stock market. Forward to this article investors use fundamental analysis and technical analysis to analyze stocks, charts. There are other models like discounted cash flow method(DCF) that helps investors in analyzing the stocks. I will publish the blogs on those topics soon. Thanks for reading.

Leave a Reply